If you own a small business or are self-employed, one of the biggest headaches to deal with is accounting. Investing in bookkeeping software was the best investment for our small business. It also helps avoid a human error that can often occur with manual data entry. So in this post, we will share how using one can also help you streamline your accounting and save you time and frustration.

Why Is Bookkeeping Important In Business?

If there are certainties in life, it is death and paying taxes. Properly filing your business income and expenses is so important, even if you’re paying a professional to do so. You will want to be able to give your CPA the right information and do your part to cover you and your business in the case of an audit.

An equally important reason for using proper bookkeeping is that it provides an accurate picture of your business cash flow. When your numbers are organized, it allows you to review your business performance so that you can make adjustments. You may find that you need to reallocate resources to certain projects or to cut out other budgets that you may be overspending on.

Which Bookkeeping Software Is Best For A Small Business?

There are many bookkeeping services and software out there from free to ones you will have to pay for. We run multiple e-commerce businesses and sell on platforms such as eBay, Etsy, Amazon, and several others. The software that fits our needs and one we use is GoDaddy bookkeeping.

GoDaddy has a no-fuss, easy-to-use setup and interface, along with selling platform integration and tax organization with select plans. The plans start at $4.99 for a Get Paid plan, then $9.99 for an Essential plan for more features, and $14.99 for a Premium plan per month. The plan we pay for is a $9.99 Essential plan and it is worth every penny to save us the hours upon hours we would have spent on accounting otherwise. You can find their banner below.

Easy Set Up & Use

What we like about GoDaddy is that as soon as we started setting up, we found the site easy to navigate and intuitive from the get-go. We wanted to be able to spend the least amount of time on bookkeeping so the simplicity was very much appreciated.

What do you need to start using GoDaddy bookkeeping? You will need to link all your business accounts, including banks, credit cards, and any other payment system your business uses such as PayPal or Stripe. GoDaddy makes this easy to do by giving you a checklist on their homepage.

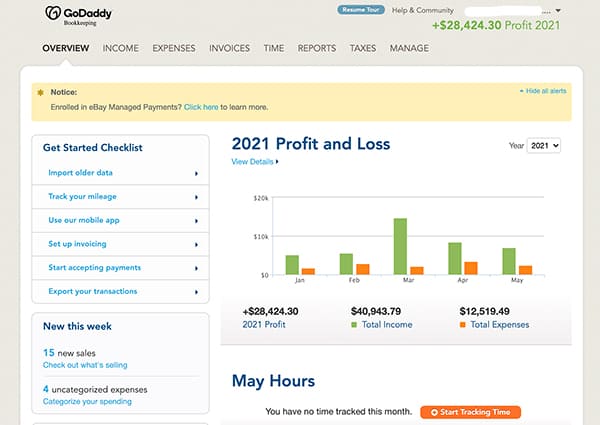

You can create and customize your reporting categories and we suggest you do this work upfront so that you will be set. This will help with Schedule C for taxes later on. Once you have your information entered and categories sorted, you will be able to see an overview of your income and expenses for each month of the year.

You can also create and customize your invoices. For the Essential and Premium plans, you will be able to pull up as many reports as you’d like. We’re a fuss-free small business that doesn’t require fancy charts or reports but it is nice to have that option should we want it in the future.

Direct Integration With Selling Platforms

As we mentioned, we sell on Amazon, eBay, Etsy, and other online platforms that take PayPal payments. GoDaddy will pull transactions with nightly updates so your accounting is accurate and current.

Others have mentioned from time to time that the updates may lag a day or two but we personally have not noticed this. We do not necessarily need a daily update because we don’t need to check our bookkeeping everyday. For us, that takes time away from revenue generating activities so it is not an issue for us.

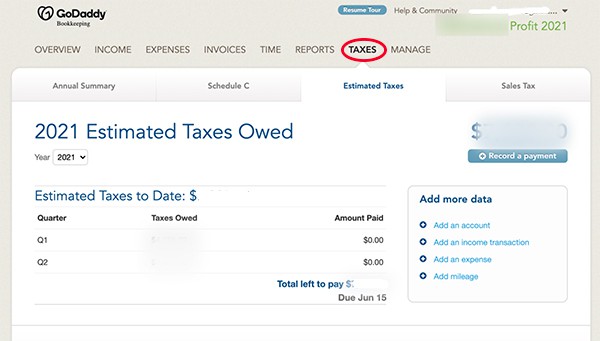

They Provide Estimated Quarterly Taxes

One of the most helpful features that GoDaddy offers is that they will give you an estimated tax per quarter with your data. This helps us tremendously because we do pay our taxes quarterly, instead of in one big lump sum. This option is only available on the Essential plan and Premium plan.

It is important to make sure that software categorizes your income and expenses correctly at first. This is especially for tax purposes. You may find that you will have to do this throughout the year if your expenses come from new vendors than the ones you have used before.

Bookkeeping When Self-employed

It is easy to procrastinate and put off doing accounting throughout the year. But once tax season comes, it can cause a form of PTSD. At least that was the case for us before we said enough and looked into better bookkeeping. Many small businesses like ours do not have an accounting department or employee to handle our day-to-day costs to do business.

Keep in mind that GoDaddy does not have payroll services like some of its competitors. We do not have employees currently so this is not an issue for us. But when we looked for bookkeeping software for our small business, GoDaddy’s simplicity is what attracted us in the first place. We had experienced some very poor and frustrating customer service with one of their major competitors.

GoDaddy also does not track inventory. We personally have our own inventory management system but we categorize our Cost of Goods under Business Expenses. GoDaddy is great for basic, simple bookkeeping.

GoDaddy bookkeeping software allows us to be on top of our accounting for our small business, while not taking our time away from our daily tasks.

Summary: GoDaddy Bookkeeping Software For Small Business

While we use and recommend GoDaddy bookkeeping software for our small business, we appreciate having as many facts as possible when we make decisions. So we will summarize the pros and cons below for you to make an informed decision.

Pros:

- User friendly, easy to use

- Integration with major online selling platforms (eBay, Amazon, Etsy, Shopify)

- Quarterly taxes estimation & Schedule C

- Invoicing capabilities

- Affordable

Cons:

- Cannot do payroll

- Does not track inventory

- Too simple for bigger businesses needing forecasting or budgeting

- Cheaper alternatives out there for similar capabilities

Other Useful Tools For Small Businesses

Other than the bookkeeping software, there are a few other tools that we cannot live without when it comes to running our small online business. They include shipping software to give us commercial pricing on postage. Shipping software is free to use but you are able to get the shipping discounts through them. We particularly have used two: one for USPS only and the other for multicarrier options.

USPS ONLY

For USPS-only postage, Pirateship.com is beginner-friendly and easy to use. We have many articles on how to ship with pirate ship here, here, and here.

Multi-Carrier

Shippo is our choice for multi-carrier shipping software. USPS, UPS, and DHL Express are completely free to use. You can still access a discounted negotiated rate with FedEx and other international and regional carriers through a monthly plan that’s suited for your business needs. For more than 55+ carrier options, Start Shippo 30-Day Free Trial at GoShippo.com.

Shippo and Pirate Ship’s discounts for USPS are the same. If you ship multiple types of packages and have to only choose one shipping software, choose Shippo for more carrier options. Pirate ship is just easier to use for USPS packages.

Printers

We use multiple types of printers, including thermal printers, inkjet printers, and laser printers. We use each type for different needs but we use our thermal printer every single day to ship out orders. We currently use this one but there are many great options out there. Check out our full Recommendations page for your particular budget.

What Every Small Business Owner Should Know

Lastly, make sure to check out tips here for what you can do as a small business owner to ensure you make the most out of the tools and resources available to you. The more options you know that you have will help you save time and business expenses. Investing a few minutes to learn often will help you improve your workflow and thrive as a small business owner.